Tesla has been making headlines recently, not just for its electric cars but also for its incredible stock journey. Actor Morgan Freeman, who famously declared his ownership of Tesla stock in 2016, has seen his investment soar dramatically. This news can spark interest among young investors and curious minds alike. But why is Tesla stock flying so high, and what can we learn from Freeman’s story?

The Rise of Tesla Stock

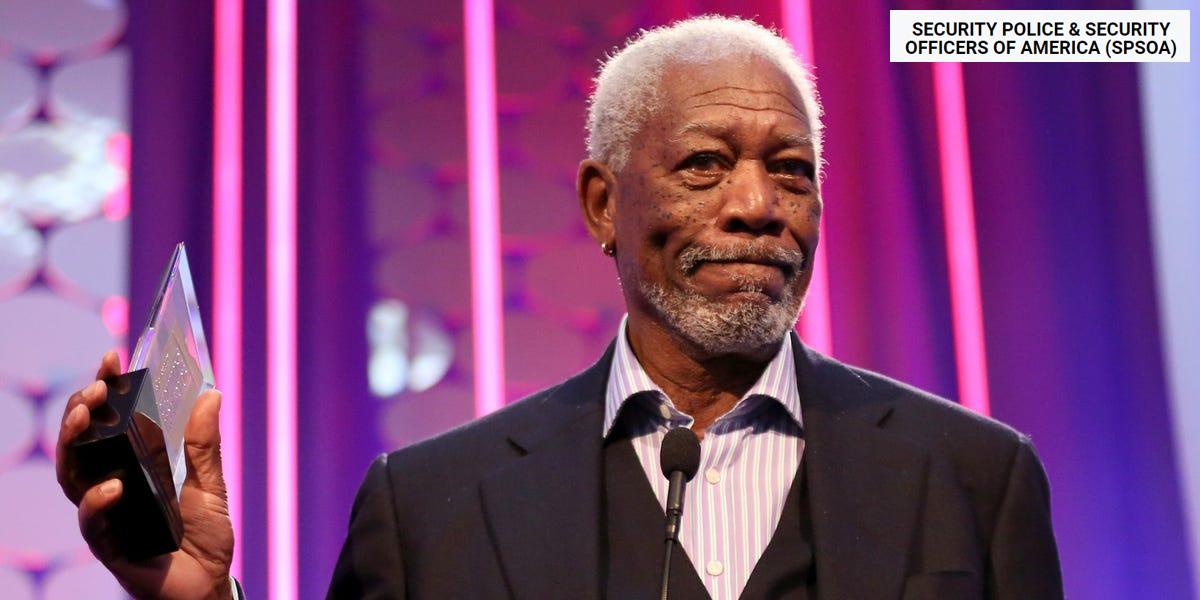

Back in 2016, Morgan Freeman appeared on CNBC and shared an interesting tidbit: he owned shares of Tesla. At that time, Tesla’s stock price was around $13.50 per share. Fast forward a few years, and Tesla’s stock value has increased significantly, now trading at approximately $415. This remarkable rise means that shares bought during Freeman’s initial investment have increased about thirty-fold!

Freeman’s Big Gamble

So, why did Freeman choose to invest in Tesla? During his interview, he expressed admiration for the company’s vision of a sustainable future through electric vehicles. This hope for a greener tomorrow is something many young people care about today. However, Morgan Freeman’s publicist recently declined to comment on how many shares Freeman currently holds, leaving fans and followers speculating about the true extent of his investment triumph.

Market Implications

Tesla’s market has not just been about its stock price; it has also surged in market capitalization, growing from $30 billion to about $1.3 trillion. This shake-up in the market shows that people are increasingly investing in companies that are trying to change the world, especially ones that focus on renewable energy and technology.

Is Now the Time to Invest?

As many consider investing in Tesla, some crucial factors come into play. Tesla is expected to release its fourth-quarter earnings report on January 29, 2025. Recently, there have been mixed signals in its performance: on one hand, the stock has doubled in the past year; on the other hand, sales have faced hurdles, with vehicle deliveries slowing down and profit margins declining due to price cuts on cars.

What’s Next for Tesla?

Many analysts are keeping a close eye on Tesla as it tries to diversify its business. Beyond electric cars, Tesla is diving into areas like solar energy, battery technology, artificial intelligence, and even self-driving cars. Elon Musk’s other venture, xAI, has secured funding that could lead to more tech innovation, potentially boosting Tesla’s overall success.

Final Thoughts

But, with high rewards come high risks. Tesla’s current price-to-earnings (P/E) ratio is at 111, which means it’s trading at a premium compared to its earnings—this usually signals that buyers are very optimistic about the company’s future. For young investors eager to jump into the stock market, learning about these aspects can be as important as understanding the basics of buying shares. Morgan Freeman’s story shows that investing can lead to amazing successes but also emphasizes the need to be cautious and informed.

Table: Tesla Stock Performance Over the Years

| Year | Stock Price (Approx.) | Market Cap (Approx.) |

|---|---|---|

| 2016 | $13.50 | $30 billion |

| 2024 | $415 | $1.3 trillion |

In conclusion, as Tesla continues to grow and evolve, stories like Morgan Freeman’s remind us of the potential that lies within the thrilling world of stock market investments. Whether you’re an aspiring investor or simply curious about the company, keeping up with these changes can lead to insightful conversations about the future.